Why Fixed Deposits (FDs) are Not a Good Investment for Young Investors

.

Fixed Deposits schemes are offered by banks or NBFC ( non banking financial companies), where you deposit a lump sum amount for a set period of time on which you earn predetermined interest. Unlike normal savings accounts, you receive slightly higher interest on your deposits and receive the principal amount along with interest earned at the end of the tenure.

As far as investment is concerned in India, the fixed deposits (FDs) are the most popular and have always been considered as stable and safe. That makes FDs an excellent choice for the conservative and aged investors who are nearing their retirement and don’t want to take many risks in the later stages of their life.

On the other hand, young investors who are in their 20s or 30s have the advantage of time which they can utilize to remain invested in equity for a longer duration and ignore the short term volatility. Investing via monthly SIP into index funds is a proven way to build wealth and beat inflation. Try using a SIP investment calculator and find out the future value of your portfolio and make sure you’re on the right track to achieve your financial goals.

In the contemporary world there's plenty of different investment options available for young investors but too much reliance on fixed deposits might take away the chances of creating more wealth. Let’s dive deeper and find out in detail why fixed deposits are not a good choice of investment for young investors?

FD yield lower return with respect to inflation

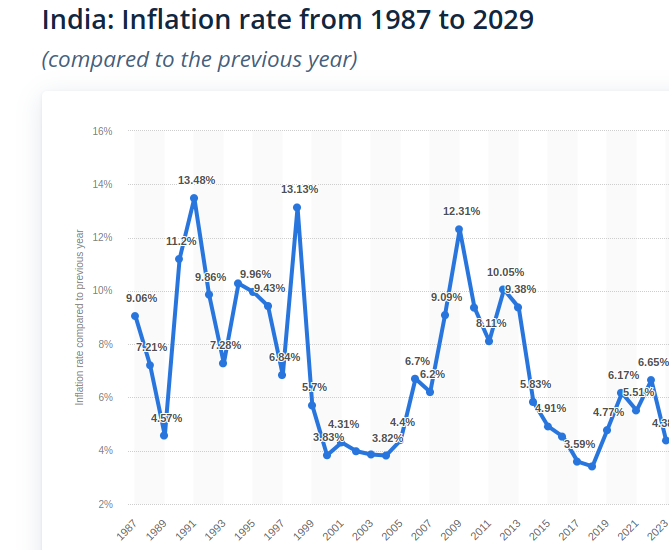

As of June 2024 the top-tier banks in India offer interest rates on fixed deposits between 6% to 7%. For instance, the interest on at least a 12 month deposit in SBI is 6.50% and on the other hand HDFC, the largest private bank in India offers it at 6.70 %. The account holders of above 60 years receive 7.0% interest on FD in SBI and 7.10% interest in HDFC bank. When we talk about inflation, as I write this article the last recorded annual consumer inflation rate in the month of June 2024 in India was 5.08% with average around 6.0% for the last 5 years. Which is quite in the mid-range but as we see in the historical chart below, a few months also recorded an inflation rate of even higher than 13 %.

Image Credit : statista

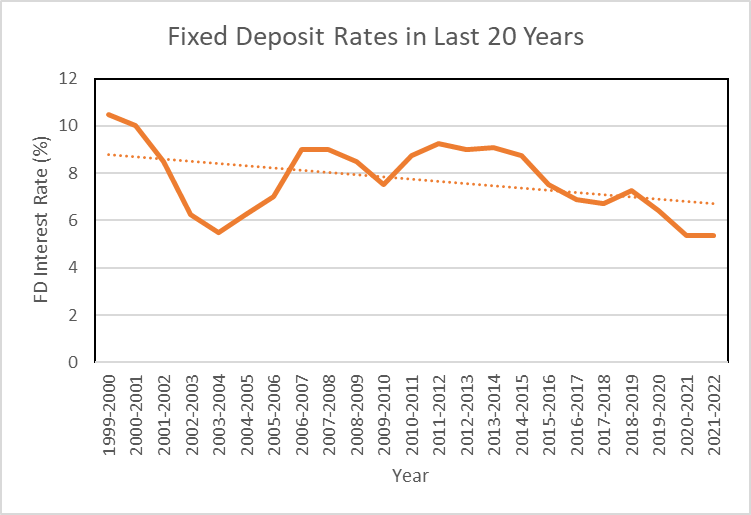

Before the year 2000, the interest rate on fixed deposits was around 10% but gradually year on year the average fixed rate offered by banks in India has been declining and reached all the way to 6%. With a high inflation environment, a fixed deposit interest between 6% to 7% will leave nothing saved into the pockets of young investors.

Image Credit : Bajaj Finserv

Interest earned on fixed deposit is taxable

Income earned through fixed deposits are subject to taxation. When your income from interest rate on fixed deposit exceeds the threshold amount of Rs 40,000 or Rs 50,000 (in case of senior citizens), the TDS (tax deducted at source) of 10% is deducted by the bank. As a young investor this makes it less attractive as their income is likely to go up in the future. Knowing that 10% TDS will be deducted every year in the interest credited make them deposit a lesser amount as FDs or just below the taxation threshold.

Better investment options

Young investors usually have higher risk appetite, lesser liabilities and ample amount of time to leverage the compounding effect. Simply, locking their money into fixed deposits will stop them from investing into better assets like equity and mutual funds. Based upon historical data, equities and mutual funds have outperformed the FDs. For instance, sensex has given theannualized return of 12.5% in the last 10 years, whereas the NIFTY 50 return for the same period stood at 13%. Investing into higher performing assets helps in easily achieving the financial goals. Not sure which index funds to pick, have a look at some of the mutual funds recommended here for the equity and debt part of the portfolio.

Penalty on premature withdrawal

Young investors may occasionally need funds for any opportunity or an emergency. Although, you can withdraw money from a fixed deposit partially or fully anytime before its maturity but premature withdrawal incurs a penalty. Typically Indian banks impose a penalty of 0.5% to 1.0% on withdrawal amount which further impacts the net return on your fixed deposits. This lack of liquidity in fixed deposit assets is a major drawback and makes the investor look out for better investment options.

Impact from monetary policy

Interest on FDs are often impacted by monetary policies from the RBI (Reserve Bank Of India). RBI alters the Repo rate ( Repurchasing Option - rate at which RBI lends money to other banks in India) from time to time to control the inflation or boost the economy which ultimately influences the interest rates on fixed deposits. When Repo rate increases, the other banks also increase their interest rate on FDs to manage the borrowing cost by attracting more deposits. Conversely inline with RBI, when Repo rate decreases, FD interest rates also declines reducing the need of banks to attract more deposits. This unpredictability of interest rate on FD makes it unappealing to young investors.

Conclusion

Although fixed deposits are an excellent choice for those investors who do not want to take risks and need guaranteed returns in future. As previously mentioned, FDs come with many drawbacks such as - less return in high inflation environment, taxable, less liquid and penalty on premature withdrawal. Young investors have enough time on their hand to leverage it. They can look for better investment opportunities that promise good returns. Also, they can remain invested for longer duration and thus mitigating the financial risks.

DISCLAIMER : Any investment is subject to risk. This article is written for informational purposes only and the author or the website owner does not guarantee the accuracy of the data provided above. Before taking any investment decision please do your own due diligence or take the advice of a certified financial expert.

Relevant Articles :

- FD vs Real Estate Investment

- https://sipcalculator.in/sip-vs-lumpsum

- https://sipcalculator.in/sip-vs-swp